Akhuwat Loan Detail: Comprehensive Guide to Eligibility, Application, and Benefits

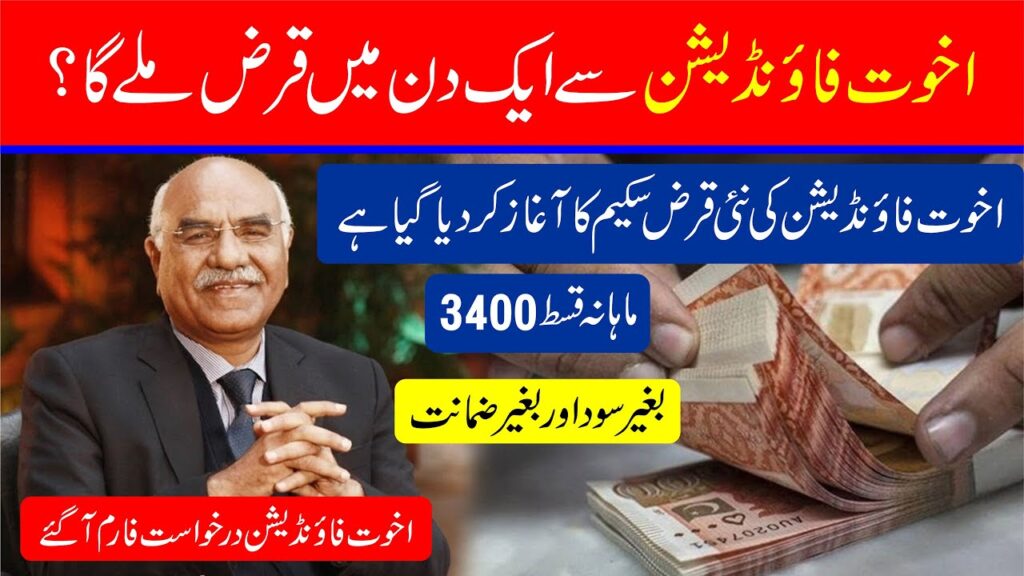

The Akhuwat Loan Detail is an essential resource for anyone seeking interest-free financial support. As one of Pakistan’s most impactful microfinance initiatives, Akhuwat aims to uplift underprivileged communities by providing Shariah-compliant, interest-free loans. This article delves into every aspect of Akhuwat Loan Detail, including eligibility criteria, the application process, loan benefits, and repayment terms.

What is Akhuwat Loan?

Akhuwat Loan is a welfare-based microfinance program designed to support low-income individuals and small business owners. Unlike traditional loans, Akhuwat loans are interest-free, in accordance with Islamic principles. This initiative helps people achieve financial independence and fosters a sense of community by encouraging beneficiaries to “pay it forward” after their loan is repaid.

Why Should You Consider Akhuwat Loan?

Akhuwat Loan offers numerous benefits, including:

- Interest-Free Financing: No hidden fees, interest, or mark-up.

- Flexible Repayment: Borrowers can repay the loan according to their financial capacity.

- Empowerment and Independence: Supports small businesses, education, and health needs.

- Community Support: Contributions are recycled to support new beneficiaries.

With these features, Akhuwat loans provide a sustainable path to financial independence.

Akhuwat Loan Detail: Types of Loans Available

Understanding Akhuwat Loan Detail involves exploring the different types of loans they offer. Here’s a breakdown of the primary loan categories:

- General Loan: For micro-entrepreneurs and small business owners.

- Education Loan: To support students in pursuing higher education.

- Marriage Loan: Financial assistance for marriage expenses.

- Health Loan: For medical treatments and health emergencies.

These loans are tailored to address the unique financial needs of individuals and communities.

Akhuwat Loan Detail: Eligibility Criteria

To apply for an Akhuwat Loan, you must meet specific eligibility criteria. Here are the primary requirements:

- Age: Applicants must be at least 18 years old.

- Income Level: The applicant must belong to a low-income household.

- Business or Purpose: The loan must be used for a specific, valid purpose such as business expansion, education, marriage, or health expenses.

- Community Support: The applicant should have a positive social reputation in their community.

- Guarantor: A guarantor’s recommendation is often required.

These criteria ensure that the loans reach those who genuinely need them.

Akhuwat Loan Detail: Step-by-Step Application Process

Applying for an Akhuwat Loan is simple and transparent. Here’s a step-by-step guide to help you navigate the process:

- Visit the Nearest Akhuwat Center: Locate the nearest Akhuwat office in your area.

- Submit the Loan Application: Fill out the application form and provide the required details.

- Attach Necessary Documents: Submit identification, proof of purpose, and guarantor details.

- Interview and Verification: Participate in an interview and home/business visit for verification.

- Loan Approval: If approved, the loan is disbursed directly to you.

The application process is designed to be fair, efficient, and transparent.

Documents Required for Akhuwat Loan

To complete the application, you need to provide the following documents:

- National Identity Card (CNIC)

- Proof of Address

- Photographs

- Guarantor’s Details

- Income Proof or Purpose Documents

Having these documents ready will expedite the application process.

How to Repay Akhuwat Loan?

Repaying an Akhuwat Loan is simple and flexible. Borrowers can make payments at their local Akhuwat center. The repayment schedule is based on the borrower’s financial capacity, ensuring that no undue financial burden is placed on them.

Benefits of Akhuwat Loan

Here’s a quick summary of the major benefits that come with Akhuwat loans:

- No Interest: 100% interest-free, Shariah-compliant loans.

- No Hidden Charges: Transparent process with no additional fees.

- Easy Access: Available to individuals with low-income status.

- Sustainable Model: Loan repayments fund new beneficiaries, fostering a cycle of support.

These benefits make Akhuwat Loan a life-changing opportunity for many families.

FAQs About Akhuwat Loan Detail

1. How much loan amount can I get from Akhuwat?

The loan amount depends on the purpose and financial needs of the applicant. For general loans, amounts typically range from PKR 10,000 to PKR 50,000.

2. Is there any interest charged on Akhuwat loans?

No, Akhuwat loans are interest-free. This aligns with the organization’s mission to offer ethical, Shariah-compliant financial assistance.

3. Can students apply for an Akhuwat Loan?

Yes, Akhuwat offers education loans to students pursuing higher education.

4. How long does it take for a loan to be approved?

The loan approval process can take up to 2-4 weeks, depending on the verification and processing time.

5. What happens if I fail to repay the loan on time?

Akhuwat works with borrowers to create flexible repayment plans. Borrowers are encouraged to discuss their financial situation with Akhuwat’s support team.